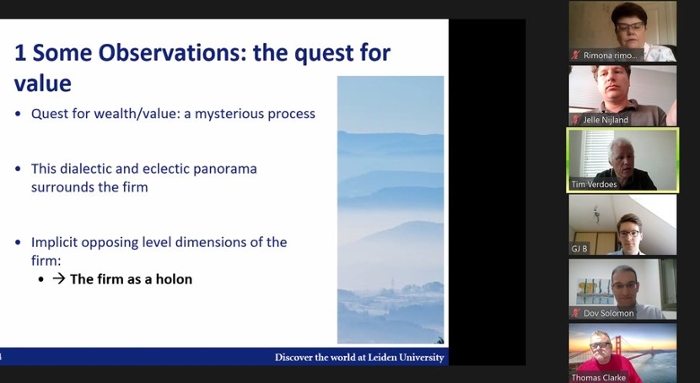

SASE Conference: The multifaceted relationship between value and the firm

On Monday 20 July 2020, members of the Business & Liability Research Network (BLRN), Tim Verdoes (Business Studies), Jelle Nijland and Gert-Jan Boon (both Corporate Law) contributed to the online conference Society for the Advancement of Socio-Economics (Sase). This years' conference was themed 'Development Today: Accumulation, Surveillance, Redistribution'. The presentation was entitled "The multifaceted relationship between value and the firm: a dialectic and eclectic approach to corporate governance".

The presentation, embedded in the SASE network on Accounting, Economics, and Law, Corporate Governance: Theory and Practice, dealt with the multifaceted nature of the firm, as well as its quest for value. Professor Thomas Clarke (University of Sydney) acted as a discussant of the paper. The publication of the paper is expected later this year.

The Janus Head of society and agents

Adam Smith’s ‘origin-of-wealth theory’, on the essence and genesis of economics, identifies two different levels of value creation: the individual and society. The firm is presented as the missing link as a separate, intermediate level. The ‘face’ of the firm could be focused at two different directions: society and agents (stakeholders), like a Janus Head. In essence, value is not created in isolation, but in the interplay between markets and firms. However, the firm cannot easily be accommodated with the principles of welfare economics. The firm is at odds with the assumptions of welfare economy in which the firm is nonexistent. This creates a dialectic and eclectic “firm-market”-framework. As such, long term value creation is the result of a largely unknown mysterious process. This finding has repercussions for core corporate law and governance concepts such as defining the purpose of the corporation.

A dialectic and eclectic approach

Many paradoxes are revealed in the quest of this study into welfare economics, directed at concepts of value, the firm and the corporation. They are also the result of the dialectic spectrum of corporate law and corporate governance when describing and justifying the core of corporate concepts. Such conflicting dimensions appear in particular in recognizing different value related concepts, such as: shared value, shareholder value, captured value, and (long term) value creation. Value creating (or capturing) ideas are (implicitly) at the core of the theories of the firm.

The firm as a ‘holon’

The paper focuses on the different levels and dimensions of value creation by considering the firm as a 'holon'. It posits that a firm can on the one hand be considered as a whole and a sum of its parts (for instance, as based on its stakeholders), and on the other hand and at the same time be an independent part of a larger (market) system. In corporate law and governance a firm should, according to us, be considered such a holon which represents at the same time the often found conflicting dimensions and different levels of firms. This creates a dialectic nature of the value creating firm which is also at the essence of corporate law and governance. These dimensions are implicitly present in the core concepts of corporate law and governance such as enduring success, continuity, corporate interest, stakeholders, and the new envisioned purpose of the corporation: long term value creation.