A global tax treaty

Multinationals use loopholes in the tax treaties between different states. A possible solution would be to eliminate all these loopholes in one go by creating a central global treaty. Leiden researchers are investigating whether this kind of mega-treaty is feasible.

Loopholes in fiscal legislation

The original purpose of tax treaties between States was to avoid double taxation and to stimulate companies to develop their economic activities across borders. Until a few years ago, most of the studies of these treaties focused on potential overlap in legislation. However, there are also loopholes in the agreements between countries which multinationals exploit. An example of such a loophole is the case of hybrid entities. For instance, one State – in applying its own national rules – may not regard an entity as a corporate taxpayer. In such a case, it would leave taxation to another State, for instance where the shareholders or partners in that entity are based. If that other State would do the same, i.e. leave the taxation right to the other State, the company would not be taxed in either of the relevant States.

4,000 tax treaties worldwide

In order to eliminate these kinds of loopholes in tax legislation, treaties have to be adjusted. There are currently nearly 4,000 bilateral tax treaties worldwide. ‘To adjust them all to fit the current social norms and values, treaty mediators would have to travel around the world to conduct negotiations in all the partner countries. This is clearly not feasible,’ says researcher Dirk Broekhuijsen. The question is if and how all treaties can be adjusted in one single operation.

Mega-treaty

A promising solution is a multilateral treaty, also known as the ‘mega-treaty’. This is complicated by the fact that current international tax law is based on bilateral treaties. Such treaties offer most space for a customised approach; a tax treaty between the Netherlands and Belgium will look different from a tax treaty with Ethiopia because very different interests are at stake in the two situations. According to the Leiden researchers, a mega-treaty is only feasible if the design of the treaty leaves space for countries to include bilateral agreements.

Political will

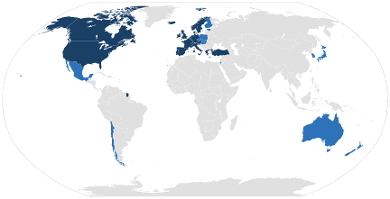

Research on this issue is particularly relevant because there is currently a strong political will worldwide to find a solution to this problem. The Organisation for Economic Collaboration and Development (OECD) has launched a project on this topic. Earlier this year, the G20 countries commissioned the OECD to formulate such a mega-tax treaty. Broekhuijsen: 'It is at present unclear whether the G20 countries will ultimately accept this mega-treaty. Nobody knows exactly what the treaty will contain, so there is still a long way to go.’