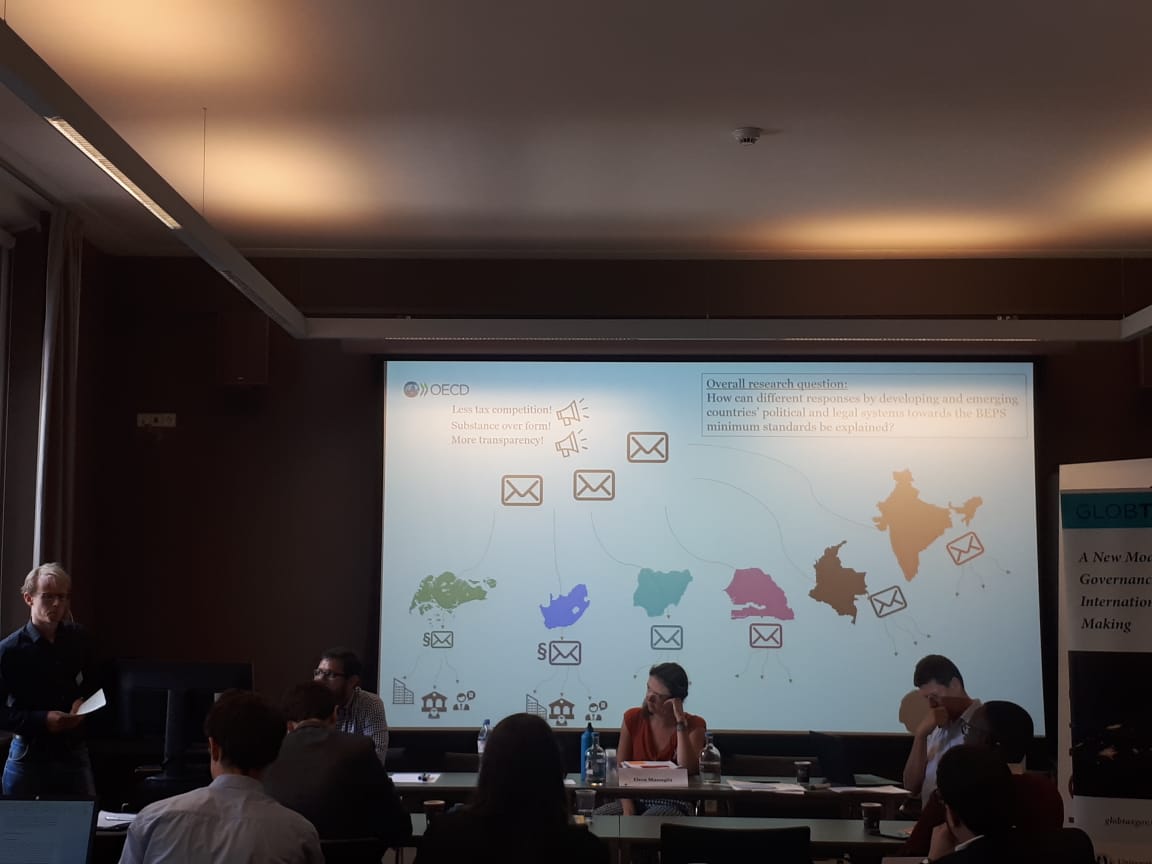

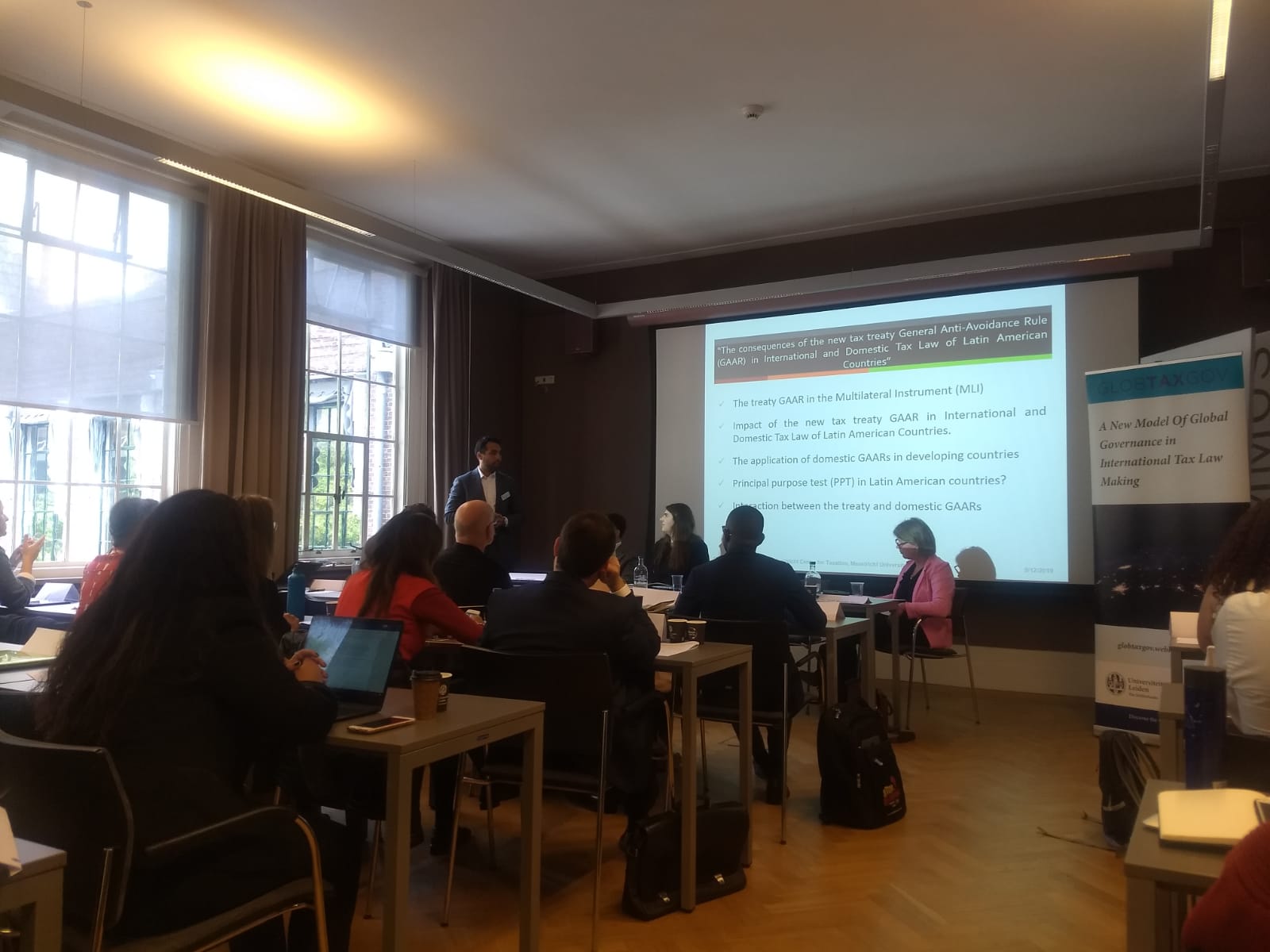

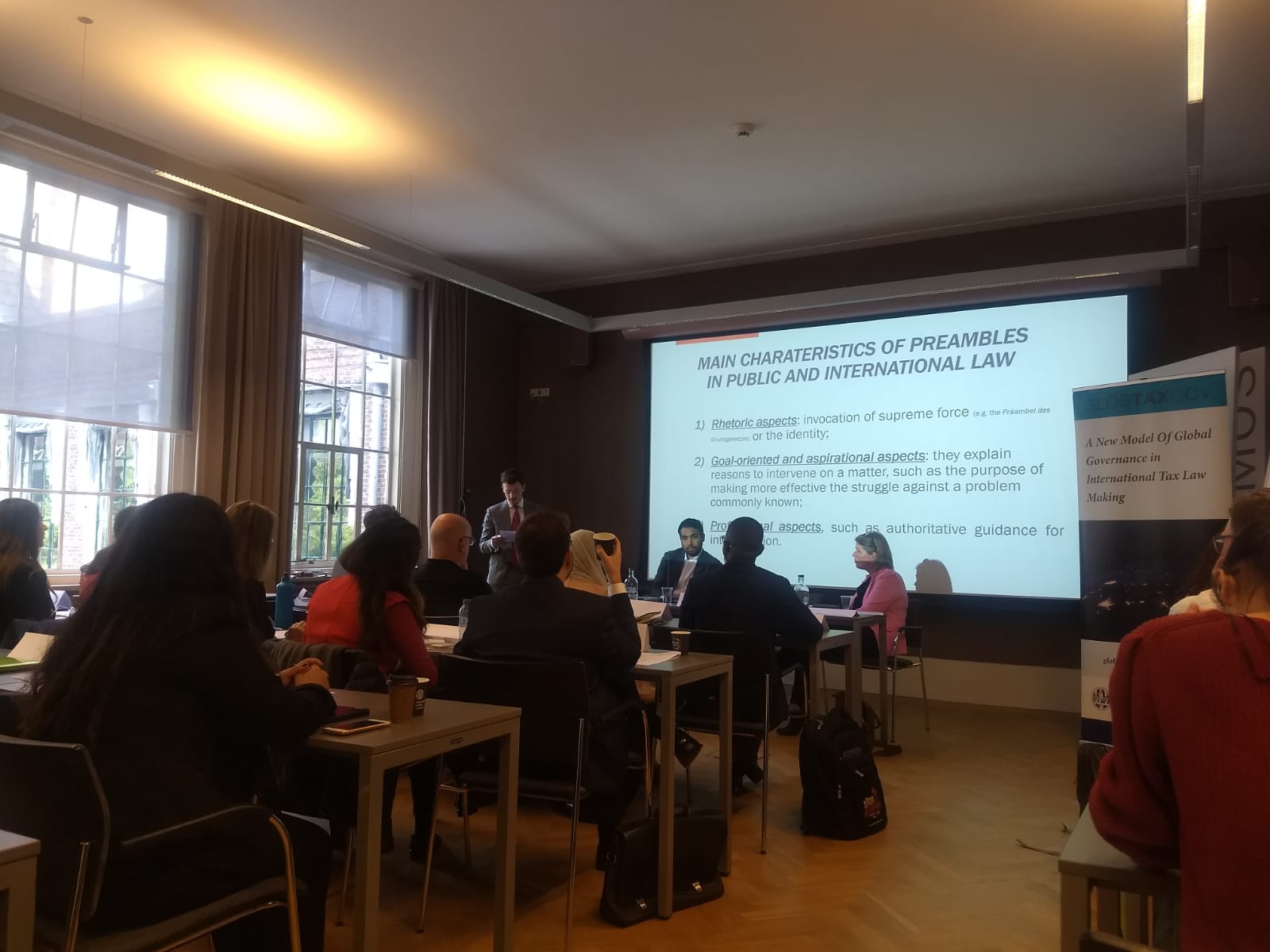

PhD seminar in Multilateral Cooperation on International Tax Law

On 12 and 13 September 2019, the Institute of Tax Law and Economics of Leiden University hosted 29 PhD researchers from around the world to engage in collective discussions at a seminar on Multilateral Cooperation in International Tax Law.

The seminar was sponsored by the Leids Universiteits Fonds (LUF) and the Institute of Tax Law and Economics, Leiden Law School of Leiden University. The initiative for the PhD seminar was developed more than 10 years ago in collaboration with the Institute for Austrian and International Tax Law at WU (Vienna), Stockholm University and Uppsala University. The seminar on 12 and 13 September was organized in cooperation with the European Research Council funded project GLOBTAXGOV (A New Model of Global Governance in International Tax Law Making) carried out at Leiden Law School (Grant Agreement 758671).

During the seminar, the PhD researchers had the opportunity to present their own research topics, by discussing with the audience their methodologies, stage of the research and finally proposing questions to the participants that might bring new ideas for continuing with the research. Each participant had to present his/her research followed by joint sessions for discussion with the audience where they could receive feedback or additional questions.

In addition, 4 lectures were given by Professor Tanja Bender, Dr Dirk Broekhuijsen, Associate Professor Irma Mosquera (all Leiden University) and Associate Professor Dries Lesage (Ghent Institute of International Studies). The topics addressed in these lectures covered 'International Taxation, DTAs and Multilateralism', 'Models of Global Tax Governance, EU Tax Law', 'Fragmentation and Complexity of Global Tax Governance' and 'Multilateralism, Tax Avoidance, Transparency and Compliance'.

The presentations aimed to provide an analysis of the current formal and substantive aspects of international tax cooperation from an international tax law perspective and a political science perspective. These two perspectives were combined when discussing the rules of international tax but also the role of the actors in the current framework of international tax cooperation. This approach made this PhD seminar innovative and multidisciplinary.

We thank once again all participants at the seminar for their enthusiasm and valuable ideas.

Keep posted about our upcoming events - the next one will take place on 16 October 2019, on International Tax Governance and Digitalization of the Economy in a Broader Perspective, in The Hague.

Deadline for registration is 10 October. Please email your request, affiliation and position to globtaxgov@law.leidenuniv.nl