Bacteria evolve gambling behaviour

In an unpredictable environment bacteria evolve the same strategy as shareholders who try to protect themselves against unpredictable swings in the stock market. Experimental evolution biologist Dr Bertus Beaumont published an article on this discovery on 5 November in the journal Nature.

Risk-spreading

The work carried out by Beaumont at the Institute of Biology Leiden (IBL) and his New Zealand colleagues for the first time demonstrates experimentally that unpredictable environments can lead to the evolution of risk-spreading gambling behaviour. Risk-spreading based on gambling often seems the smartest option to survive in unpredictable conditions. The strategy of betting on several different horses - bet-hedging - also occurs in the natural world. An example of this is the germination of the seeds of certain desert plants at random times. This increases the likelihood of at least one seed sprouting at the unpredictable point in time when enough rainfall falls.

Natural selection

As bet-hedging is successful in unpredictable environments, evolution biologists assume that this behaviour has evolved through natural selection in such circumstances. But is that right? Is it possible that a characteristic that provides an advantage under particular circumstances in the present day, evolved for this purpose generations previously? This is equivalent to an optician claiming that the human nose is an evolutionary modification to allow for the wearing of glasses: the optician's credibility would be seriously questioned.

The evolution of a bet-hedging strategy in the laboratory

New series of tests, new chances

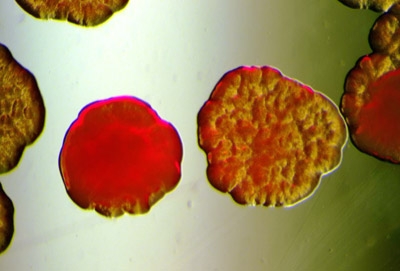

Beaumont had bacteria evolve in the lab under conditions in which they had to form colonies in order to survive. These colonies had to appear different each time. At the start this took place through mutations - spontaneous changes in the DNA - and the old bacteria died out because of the appearance of new and different types of colonies. After eight rounds of experiments, something unexpected happened: a bacterium evolved with a bet-hedging strategy that did not die out. The new bacterium was able to generate different colony types without mutations. It bet on several horses (colonies), of which there was always one that was able to go on to the next round.

Cell capsule

The new bacterium achieves this by randomly switching the production of a cell capsule (the gelatinous layer around the cell) on and off. One type of bacterium can in this way vary the number of cells with a capsule between colonies and thus make colonies that appear different. Analysis of the 6.7 million letters in the DNA code of the bacteria showed that this behaviour is caused by the change of just one letter. A number of mutations were needed to ensure that the gambling bacteria was able to develop fast enough to appear during the experiment. How precisely this one mutation leads to the random switching off of the cell capsule is not yet understood. Even with a relatively simple bacterium, the link between DNA and behaviour is often too complex to be understood without further research.

Article:

Hubertus J.E. Beaumont, Jenna Gallie, Christian Kost, Gayle C. Furguson & Paul B. Rainey. 2009. Experimental evolution of bet hedging. Nature 5 November 2009 (DOI: 10.1038/nature08504).