Research project

Dynamic Capacity Investment under Competition

What is the optimal investment policy according to which a firm adapts its capacity in a competitive market?

- Contact

- Xishu Li

Summary

Capacity investment refers to the change in a firm’s stocks of various processing resources over time. These resources include fleet, warehouse, production line, technology capability, etc., and the change can take many forms, e.g., purchase, sale of assets, merge and acquisition. Firms face a number of challenges when making such changes, since capital assets are costly, an investment is usually irreversible, and future rewards are uncertain. Often, the goal of capacity planning is to minimize the discrepancy between a firm’s capacity and demand in a profitable way. However, doing this is not always possible when firms compete in quantity and in the long run. In a competitive market where dominant firms exist and product price fluctuates with these firms’ capacity, decision of one firm directly impact those of the other firms, currently and in the future. Investment strategies that ignore competition can have fundamental problems, as they either tend to recommend waiting too long before making an investment, or underestimate the likely countermoves of the other dominant firms towards the firm’s investment decision. Without a proper theory, investment decision in a competitive market can lack guidance.

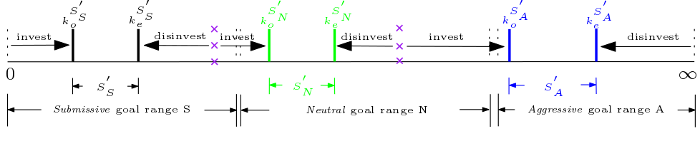

Our research project originates from practice: a staggering investment race in the container shipping market since the 2008 global recession, which has led to huge losses for many carriers and even bankruptcy for some. We try to explain this phenomenon by developing an investment model, in which leader and follower firms act sequentially and a firm’s capacity decision interacts with the opponent’s current and future capacity. A firm can either plan investments proactively, assuming that the opponent will react using a given strategy, or respond reactively to the competition. We develop an efficient algorithm to derive a firm’s optimal long-term investment strategy in the form of an ISD (Invest, Stayput, Disinvest) policy. The structure of our optimal polices (see an example in Figure 1) differs from the structures found in the existing literature for investments in non-competitive cases. A competitive proactive ISD policy may lead to a so-called Multi-ISD decision rule. It can lead to non-obvious decisions in practice. For instance, holding more assets in the competition may trigger investments for a firm, while having fewer assets may trigger disinvestment.

We validate our model using detailed data from the container shipping market (cost, capacity and demand, 2000-2015). It appears that the optimal capacity decisions from our model fit the capacity realization of two dominant shipping liners well. The contribution of our project is therefore not only in the new model, but it also yields interesting managerial insights. First, since the optimal capacity determined by our competitive investment model is consistent with the realized investments, these investments, which are questioned by some to be irrational, are optimal in the given competitive structure, and can be fully explained by our model. Second, we show that in the long run, proactive strategies are always better than reactive strategies in a competitive market. In fact, we are able to show why proactive thinking brings such benefits to a firm. Third, we provide a practical guideline with four steps on how to achieve an effective competitive investment strategy. We believe our model can be used very well for optimal investment decision making for both the leader and follower firms in different competitive markets.

Selected publications

Xishu Li, Rob Zuidwijk, M.B.M. de Koster, Rommert Dekker. 2018. Dynamic Capacity Investment under Competition. (Available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2741864)